COMMUNITY COLLEGE results

The sixteen Community Colleges in Maryland serve a large population of non-traditional students.

The average rate of wage visibility in the fall term for enrollees[1] at Maryland’s community colleges was 52%[2]. This is eighteen percentage points higher than the state average.

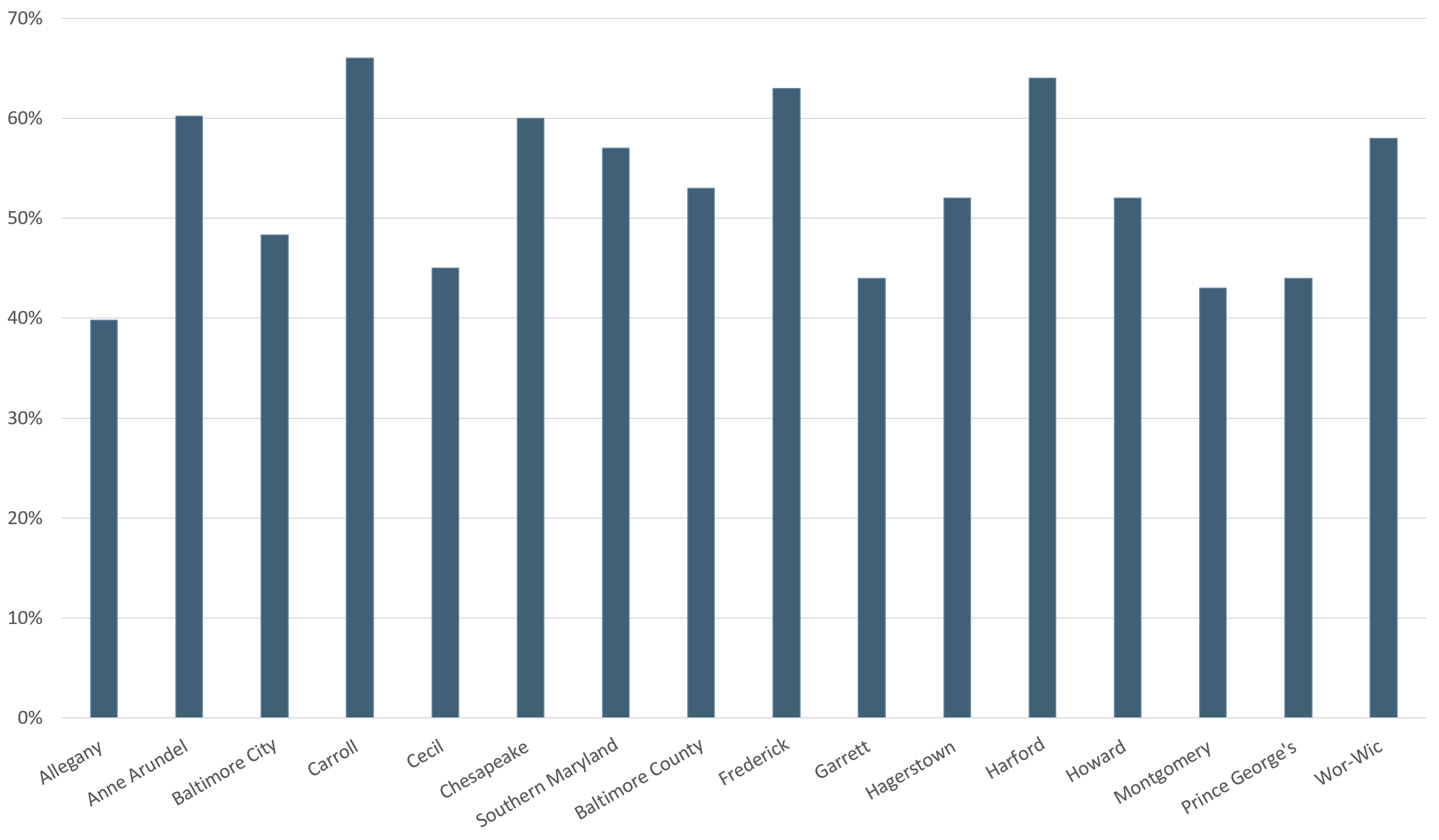

The wage visibility rate varies when looking at individual community colleges. For example, Allegany College of Maryland had the lowest wage visibility rate at 40% for the fall, while Carroll Community College had the highest rate at 66% for the fall.

The vast majority of these student worked in either the Trade, Transportation and Utilities sector[3] or the Leisure and Hospitality sector[3].

- Trade, Transportation and Utilities (34%)

- Leisure and Hospitality (33%)

- Education and Health Services (15%)

- Professional and Business Services (7%)

- All Other Sectors (11%)

Additionally, 18% of students without a wage record either participated in work-study (2%), received an institutional scholarship (15%), or both (1%) during the fall 2017 term. While the work-study students were engaged in the workforce in a part-time capacity, some of the students receiving an institutional scholarship may also have had some level of engagement in the workforce.